Brace yourselves: the change in banking is coming sooner than you expect. The world we live in is increasingly changing with each passing day, i.e., going digital and interconnected where devices not only talk to us but also with each other. Banking isn’t going to remain unaffected with this revolution for long . . . in fact long before APIs disrupted all the business verticals, Banks introduced us to ATM machines . . . which basically allowed us to not be in the queue for hours and deposit/withdraw cash on our own easily without entering the banks.

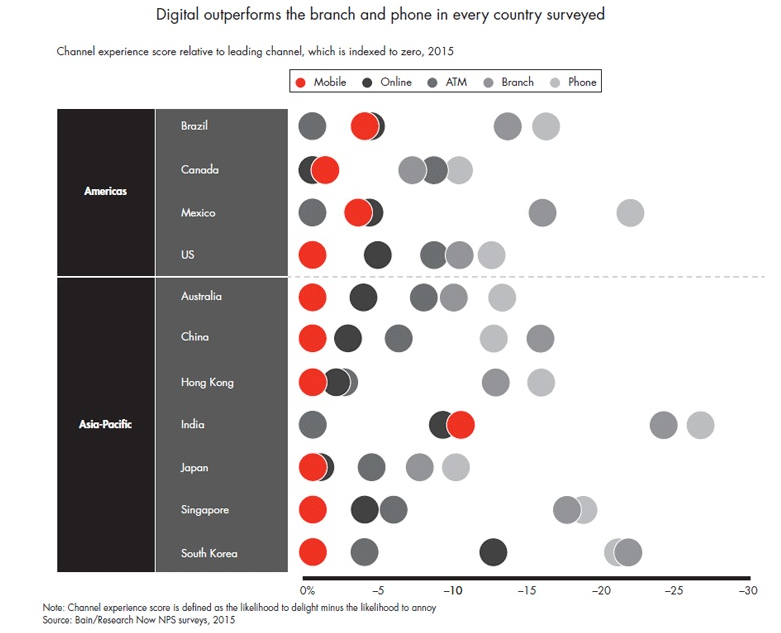

This was just the beginning. Banking is going to go on a whole new level altogether . . . overcoming all the challenges they are facing these days in exposing their internal systems, protected resources, legacy systems and huge amount of confidential data as APIs. Kristin Moyer, director of research at Gartner, stated in 2012 that “banks must transform themselves to continue to be profitable and relevant in the financial services value chain: applications stand in the way in the banking sector, as they are rigid and reactive”. This was in October 2012. Now let’s check out this graph that shows the usage of different channels of banking across various nations and the experience score each channel has received from these countries.  A close look and you must have figured out by now that mobile banking is not only gaining much popularity but also it is raking in the major part of customer delight. A routine visit to bank branch is most likely to annoy by almost 2.5 times as compared to the app interaction. The following graph shows the quality and mix of channels that influence the bank’s channel experience score.

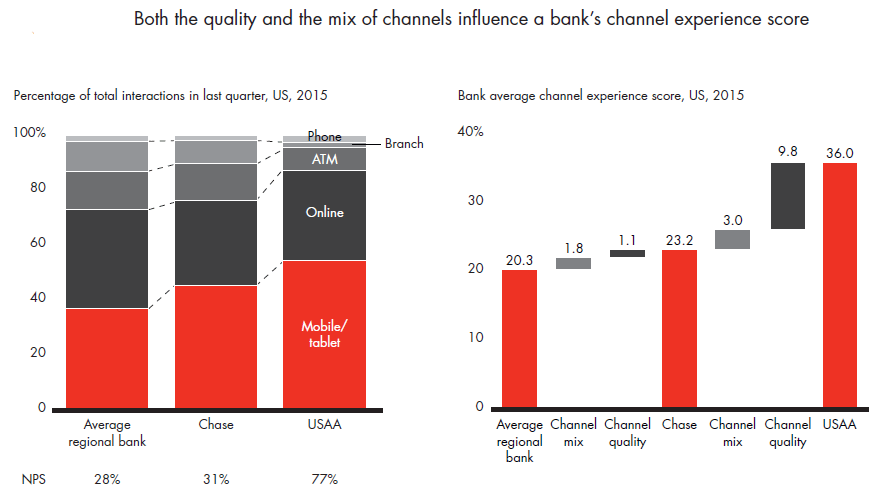

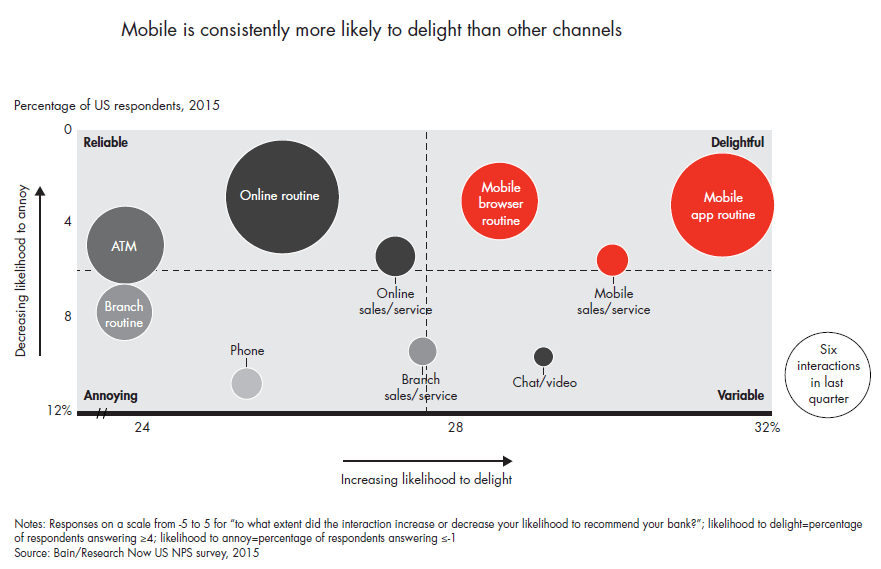

A close look and you must have figured out by now that mobile banking is not only gaining much popularity but also it is raking in the major part of customer delight. A routine visit to bank branch is most likely to annoy by almost 2.5 times as compared to the app interaction. The following graph shows the quality and mix of channels that influence the bank’s channel experience score.  Now, it is obvious that digitization is becoming an imperative step that each bank must take before it is too late. To succeed in providing delight in omni-channel banking experience, however, banks must ensure these capabilities have been embraced:

Now, it is obvious that digitization is becoming an imperative step that each bank must take before it is too late. To succeed in providing delight in omni-channel banking experience, however, banks must ensure these capabilities have been embraced:

- Extraordinary and interactive user interface, taking into account that a lot of importance is being given to the design these days and also the speed . . . users won’t hesitate in uninstalling the app if any screen takes time to load.

- Each banking process such as adding payees, third party transactions, bill payments, account statement requests, communication and all others must be streamlined and simplified for your users to quickly make routine transactions.

- Personalized user experience based on the behavior, activities and interests . . . so that only relevant information is shown to them.

- Should a customer get stuck at any screen or has any query regarding any feature, there must be a way to get in touch with quick support with proper authentication.

- Much faster development and deployment cycles to launch new and complex use cases quickly to keep up with rising customer expectations.

- An enhanced working model that provides agility within the banks and with third parties . . . exposing existing internal backend systems and offline data and marrying the two to collaborate with third-party developers.

Speaking of customer delight, the score deteriorates mostly when there is a poor experience in branches . . . can be due to any reason such as long queues, unfriendly staff, and annoying fellow customers who may not be in a good mood to cooperate. All these factors pile up to conclude that to achieve a very high customer experience it is necessary that digital banking must be strongly on the agenda. A simple look at the following graph will give you a fair idea of how mobile is clearly winning over other channels when it comes to customer delight in banking:

Challenges in opting for Omni-Channel Banking:

Most of the banks have been here for long, their infrastructure, especially IT, is built in a very complex manner . . . building layers and layers around their core systems, hereby giving rise to security and data sovereignty issues. So the banks, because of these issues, developed their systems internally . . . generating high infrastructure costs and these internal systems are becoming an obstacle on the road to digitization. Millions of dollars are being spent on installing a big monolithic traditional mobility solution that works in isolation and is complicated to customize and integrate with. Now, to overcome these challenges and to expose these resources in a secure manner as APIs, so that a new world of endless opportunities opens up, banks must opt for a comprehensive API Management solution.

Benefits of exposing protected resources as APIs:

- Mobile banking entirely depends on apps and they need APIs for internal communication

- A seamless and unified experience across all channels

- APIs can allow the bank partners to use its infrastructure to offer their own services such as co-branded credit cards, reward programs, etc. Using these APIs, the partners can track the progress in real-time and even get desired reports

- Banks could even establish a secure digital wallet for banking customers through a secure and encrypted environment for maintaining and transmitting sensitive information

- Launching new and complex services maintaining multiple payment options

- Providing real-time views of transactions and accelerating the timing of targeted offers to buyers via bank and merchant loyalty programs

- Opening up resources to online banking marketplaces that compare loan & insurance rates, credit card offers and etc.

App42 API Gateway was designed and created keeping in focus the challenges of exposing resources such as offline and sensitive customer data, accounts history, policy records and many other things. With enhanced security and multiple authentications, App42 API Gateway allows seamless extension of any app or offline data to APIs. With a comprehensive collection of API Management tools, App42 API Gateway also gives freedom for banks to choose their deployment models among shared, on-premise, on cloud or even hybrid. Apart from exposing resources as RESTful APIs, App42 API Gateway also helps banks in:

- Standardizing their internal APIs to boost their omni-channel banking presence

- Allowing to partner with third party apps for collaboration of data and services

- Generating SDKs for third party developers to integrate in their applications

- Driving developer community with APIs by publishing interactive and detailed documentation with code samples

- Monitoring the usage and sending out alarms whenever any error occurs on the APIs

- Add to that multiple traffic policies that ensure no trespassing with the sensitive data

Combine APIs and App42 API Gateway and you might just have the perfect recipe of serving the customers with a well-balanced and personalized omni-channel banking experience. To know what you can do with App42 API Gateway, click here schedule a demo. Should you require more information and would like to get in touch with us, use this form to connect and we will be happy to assist you. Click here to see how ShepHertz App42 Platform can accelerate digitization in banking industry.

Leave A Reply