What once was something beyond imagination is now soon becoming a necessity. Banks are now opening their software and other protected resources to third party developers so that they can build their own app using them. Necessity, why, you may ask. Because banks, wealth management firms, payment providers and other financial institutions face multiple challenges due to ever increasing customer expectations, compliance and internal pressures. To meet and tackle these challenges successfully, banks must focus on the single most important aspect of technology: Application Programming Interfaces(APIs).

The digitization in banking is still in process, developers are being counted upon to bring the change that banks require to survive and prosper in this changing landscape. Since last year Open APIs and Open Banking have picked up footing and have evolved from being simply specialized themes to being relevant in omni-channel banking. Outside of the industry, technical organizations wouldn’t have been what they are right now so quickly without the business quickening ability of APIs. The recent developments in fintech and the amended Payment Administrations Directive(PSD2) provisions for access-to-account have augmented the speed at which digital disruption and competition are dominating the BFSI domain. Ramifications of these developments are that Open APIs and API Banking are quickly becoming need of the hour and are not just limited to payments. However, banks do have a choice here. They can either build a simple one off API to perpetuate the monolithic model each time a specific customer comes in or to build a new banking platform altogether to solve the regulatory and compliance issues once and for all and is flexible and scalable at the same time.

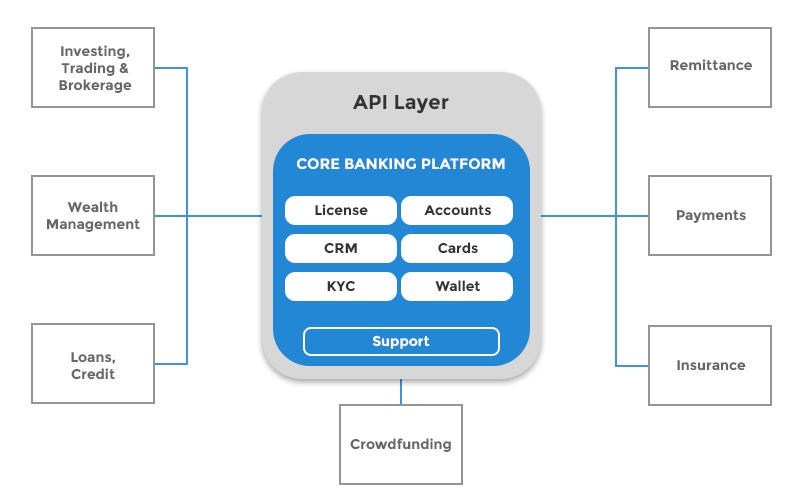

The New API Banking Platform:

Traditional banking involves banks to control their entire end-to-end banking experience through their closed system that involves bank’s point of sale, web and mobile app. The biggest advantage of this model is that all processes, technology and their components were under control but also proved to be the drawback due to which personalized experience as per the ever-changing consumer expectations wasn’t possible due to regulatory and compliance issues.

The new age banking platform involves secure exposure of bank’s protected resources as APIs that opens access for new possibilities and opportunities for innovation to meet the expectations while protecting and controlling their own interests, offline data, legacy systems and processes at the same time.

This API Banking platform sits between the backend systems of a bank and the combined experiences of that bank and third party services to enable new business models such as opening their internal infrastructure to third party developers to build their software on and provide new use cases to their customers to stay ahead of their competition. Using this API platform banks can earn long lasting customer loyalty, revamp their infrastructure and reduce time to market from months to a few days.

New Business Model and Use Cases:

As stated above, the API driven banking platform not only changes the way banking is done, but also brings in new opportunities, business models and use cases to disrupt the market completely. Let’s learn more:

Consumer Driven Market:

- Integration with the company’s ERP systems for instant validation of electronic receipts

- Instant refund payments to ecommerce customers –using IMPS APIs ensuring 24/7 servicing

- Real-time vendor transactions

- Instant reconciliation of cash transactions

- Loan Disbursements

- Real-time Information of Forex Remittance by NRIs

Digital Banking:

- Web and mobile apps with complete account info, KYC fulfillment procedures, transactions, deposit requests

- Bank services information, locations, ATM finder, promotional offers

- Cheque deposit through the camera of phones, biometric login

Partner Integration:

- Development of digital wallets

- Digital payment through web/mobile apps, IoT devices, smart wearables

- Utility Bill Payments

- Invoicing and Bill Management facility for universities and hospitals

Partner Infrastructure:

- Bank or third party partner led loyalty programs

- Real-time analytics to monitor customer activity, capital flows and market info

- Introducing bank as a trusted identity for secure authentication

- Predictive Analytics to monitor and fraudulent activity and clustering of customer data

The new banking model is heavily driven by APIs . . . and to power this model a secure, reliable, scalable and battle tested API management platform would be required. The platform must be easy enough to quickly take control of the end-to-end lifecycle of your APIs and extract the most out of them, without having too much downtime issues. This is the part where I absolutely must mention App42 API Gateway.

App42 API Gateway enables you to:

- Expose protected resources including core data, infrastructure services and legacy systems as APIs

- Standardizing their internal APIs to boost their omni-channel banking presence

- Allowing to partner with third party apps for collaboration of data and services

- Providing one of the most secure set of authentication policies for the APIs

- Generating SDKs for third party developers to integrate in their applications

- Driving developer community with APIs by publishing interactive and detailed documentation with code samples

- Monitoring the usage and sending out alarms whenever any error occurs on the APIs

- Multiple traffic policies that ensure no trespassing with the sensitive data and protection from DoS/DDoS attacks

APIs are the foundation in digitization of banking industry, enabling it to preserve their traditional methods and process and at the same time allowing third party partners to use these APIs to bring in innovation and enhance the banking industry for the end customers ensuring long lasting loyalty and staying ahead of the market disrupters. App42 API Gateway not only takes care of all these things but also comes in multiple deployment models to allow you to choose among shared, on-premise, managed service and hybrid setup. To get a complete walkthrough of the platform and to learn how it can help you transform banking, schedule a demo today. You may also go ahead for a free trial by signing up here.

Leave A Reply